Why real estate investing Money devalues and must be protected!

We are strong supporters of real estate investing money devalues over time.

In last week's article, we took a quick journey through time to illustrate how your money, my money, pretty much everyone's money is really more a "currency" than "money".

Why?

Because the bills in your pocket don't have an intrinsic value in and of themselves.

And the dollars in your pocket, at one point in time, used to be backed by something of value - like gold. Now they're not.

Remember, this isn't a complaint.

These are the rules of how the money game is being played and you'd be wise to understand them and use them to your advantage. The name of the current "money game" is "increasing the money supply". Put more and more money into the economy each and every year.

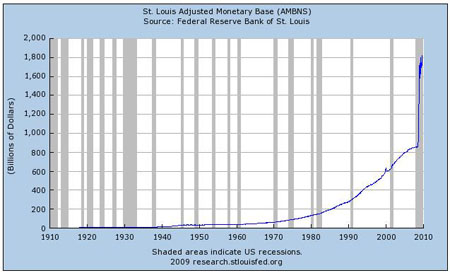

Here, take a peek at the historic level of money supply in the U.S. Until the 70's there wasn't much of an increase. But after that the monetary base begins to explode.

The last part of the chart is especially impressive.

Source: http://research.stlouisfed.org/fred2/series/AMBNS

This "devalues" your money. I use real estate investing Money needs to be protected because it loses value. Think of it this way.

If you sell apples and the entire supply of apples in Canada is 1,000,000 apples ...

what happens to the value of your apples if the next year there is all of a sudden 2,000,000 apples?

Your apples will be worth less because the supply is larger.

The same thing is happening with your money. Real estate investing protects your money! Use real estate investing money loses value!

The Federal Reserve is the money maker (along with the U.S. Treasury) and they are making lots of "apples" right now.

And don't discount this graph because we live in Canada.

Canada has to match a lot of what the U.S. does because our economy depends on theirs so much.

So Canada never wants the Loonie to get too strong against the U.S. dollar because it makes our exports more expensive for U.S. buyers.

And it does that by keeping rates super low and by putting more money into circulation.

Why not choose real estate investing money supply is increasing and money is losing value!

You could look at this as the Bank of Canada stealing from you. Use real estate investing Money loses value!

Why?

To give this a little more perspective, let me put it to you this way.

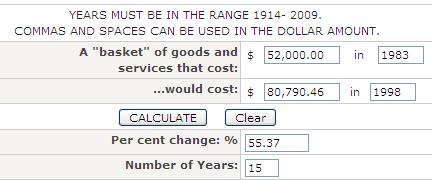

When I was about 10 I remember my father bringing home $1,000 per week or $52,000 per year. That was good money at the time.

Fifteen years later, in 1998, I was making about the same amount of money.

But because I knew less about the "rules of money" at the time I didn't understand why my $52,000 didn't feel the same.

My dad, when I was 10, seemed to be able to do more with his money. Vacations, extra mortgage payments, new bikes, cars etc.

I didn't seem to have the same ability to live that way with my $52,000.

And here's why.

My $52,000 was very different from his $52,000.

Real Estate Investing: Money Inflation is Something to Pay Attention to!

Check this out...

The Bank of Canada has the handiest little inflation calculator.

And if we punch in $52,000 back when I was ten and then see what the equal amount of money would cost in 1998 you see why I felt slightly poorer in 1998.....

Source: http://www.bankofcanada.ca/en/rates/inflation_calc.html

Check out the percentage change!!

55.37%!!!!

To be able to afford the same lifestyle my father did with his $52,000/year I would need an immediate 55% increase in my salary!

I would need to be making $80,790.46 to be able to buy the same amount of goods as my father did with his $52,000. Use real estate investing money loses value! I'm saying it again! Use real estate investing money loses too much value!

So after only a short 15 years the monetary supply had "inflated" so much that I needed almost $30,000 a year MORE to live the same lifestyle as the one in 1983. This is what I've been telling you, use real estate investing Money lost almost HALF of its value over 15 years!

There were so many new dollars (or "apples" to use our earlier example) in the market that the value of them had decreased.

That meant everything around me, like cars, mortgage payments and vacations had gotten more expensive.

Let me ask you something.

What do the monthly expenses of most of the households in Canada look like?

Likely something like this:

1. Mortgage payment or Rent payments 2. Food 3. Clothing 4. Car Payments or Transportation 5. Taxes

And I would say that most people plan for these as best they can.

But everyone ignores one thing.

Here's how the list of monthly expenses should look:

1. Mortgage payment or Rent payments 2. Food 3. Clothing 4. Car Payments or Transportation 5. Taxes 6. Inflation

But no one really plans for paying their "inflation bill" because it's invisible.

It's silent. The Bank of Canada doesn't actually mail you a bill for inflation.

But you're paying for it.

Their handy little calculator even says so.

And their little calculator to show you exactly how much you're paying. I'm trying to tell you to use real estate investing money loses value.

It's neat how this is all so "out in the open" that most people can't see it.

So our question to you is this...

What are YOU doing to pay for the silent tax that is eating away at your lifestyle?

This is why you should choose real estate investing, money only devalues over time.

Let me ask it in another way...

What are you doing to generate a 55% increase in salary for yourself over the next 15 years?

55%!

If you're making $60,000 today what are you doing so that you'll be making $93,000 in 15 years?

And that's just to make sure you're living the SAME lifestyle you have today.

What are you doing about THAT?

And if you want a better lifestyle in 15 years than you have today what are you working on that will double your income?

Because that's what you'll need to do to outpace inflation.

Inflation compounds every year, just like any other annual interest payment.

Take a look at the headlines in any of the papers.

Right now you're hearing about how companies have gone bankrupt and pensioners are having their pensions cut.

So people with a $30,000/year pension are getting it reduced by 30% or more.

That's nasty.

But my question to those people is what is life going to feel like to them 15 years from now.

Their $30,000 yearly pension will have to be somewhere around $46,000/year to just maintain their current lifestyle.

Ah, the brutality of it all.

I hope they're planning for that.

Know the rules of the money game and then work them to your advantage.

Please don't misunderstand this article as us having any form of anger about this topic.

We don't.

We just learn the rules and then play by them.

That's all.

It's a waste of time and emotional energy to get worked up about this.

It's better just to take informed action. Take control of your money with real estate investing Money loses value, I've said it a lot I know but I'll say it again, protect yourself with real estate investing Money loses value!

Some Cool Free Stuff...

Step 1:

|

Grab a free digital copy of our real estate investing book, Income For Life For Canadians, right here. This book has been downloaded over 22,597 times and has helped hundreds of investors kick-start their investing with simple and straight forward strategies that you can implement right here in Canada. |

|

|

You'll also receive our weekly [Your Life. Your Terms.] email newsletter with the latest investing updates and videos. |

Step 2:

|

Free Weekly Investing Videos & Articles: Get the latest updates and join the over 10,000 other Canadians enjoying the weekly [Your Life. Your Terms.] email newsletter. The email is sent out each Thursday. And as a little bonus we'll give a FREE digital copy of the book, Income For Life For Canadians, too! |

Your Life. Your Terms.

Step 3:

|

Free LIVE Investing Class: Do you live in the Greater Toronto or Golden Horseshoe Area? Come out to our next introductory "Investing in Nice Homes in Nice Areas" Real Estate Class. |

|

|

It's 90-minutes and you'll learn a ton - promise!Thousands of investors have now joined us for this class and the feedback has always been amazing. |